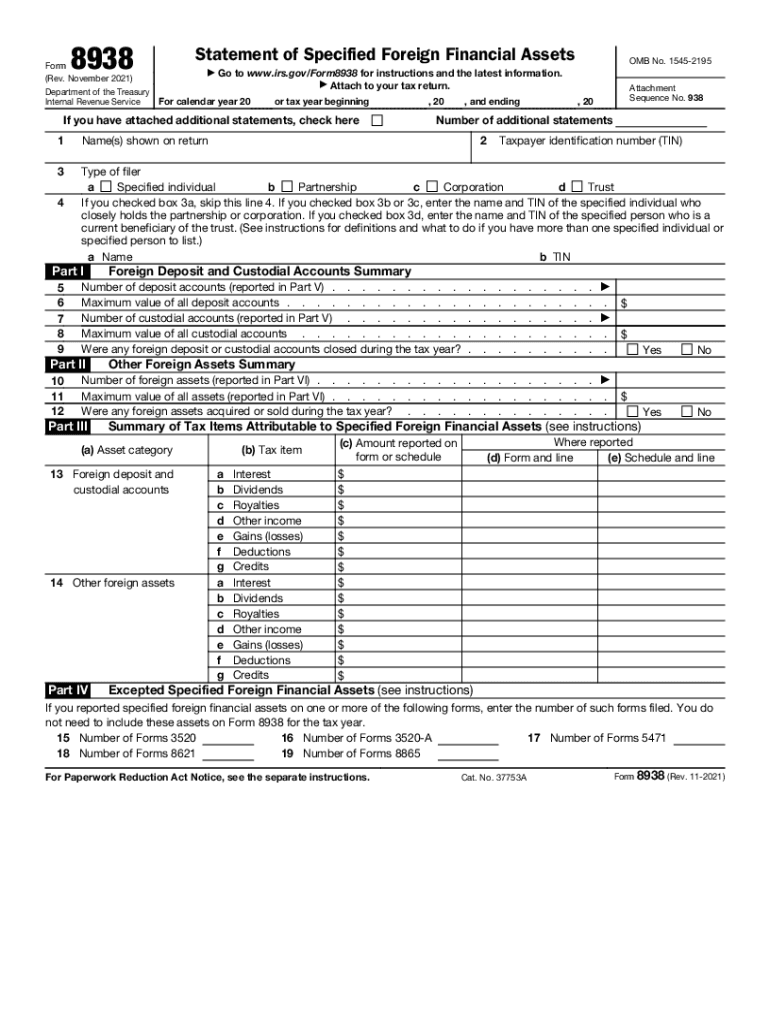

What is IRS Form 8938 2024?

Form 8938 is used to disclose all foreign financial assets specific individuals or entities (defined by IRS) hold outside of the USA. However, foreign financial assets are a collective notion. The IRS singles out a few asset types. They are as follows:

- Accounts held in a financial institution outside the USA

- Foreign stocks and bonds

- Interest in a foreign organization or corporation

- Contracts that include non-US counterparties

- Personal residences

- Any financial documentation

In addition, form 8938 is often confused with FinCEN Form 114 (FBAR). The main difference is that the latter must be filed with the US Treasury and not the IRS. Visit the IRS website to check the extensive 8938 vs. FBAR comparison.

Who must file Form 8938 2024?

Everyone who holds financial assets outside the United States or has a connection with foreign entities must fill out the document. One of the essential Form 8938 filing requirements is that the total value of all foreign assets should exceed the particular threshold, which differs depending on the taxpayer’s type. You can learn more about the Form 8938 threshold in 2025 for every taxpayer type on the IRS website.

What information do I need to complete Form 8938?

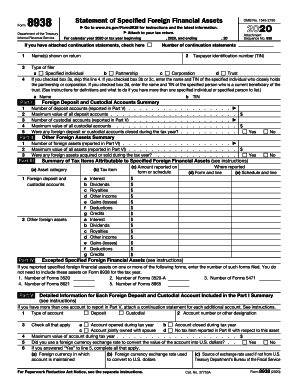

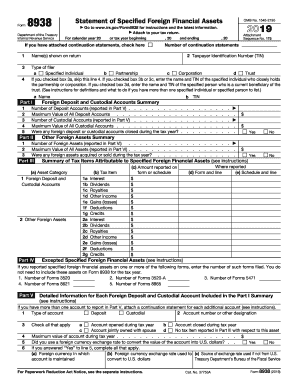

8938 Form is complicated, with four parts that must be completed. Before filling out each section of the form, individuals should complete the fields with their identification information and define which type of filer they are.

Each part of the form accounts for a particular type of foreign asset such as financial accounts, stocks, bonds, etc.

How do I fill out Form 8938 in 2025?

Before completing IRS Form 8938, read it over carefully and check the latest Form 8938 instructions. To save time and resources, you can fill out the form online with pdfFiller. Follow these steps to efficiently complete your form online:

- Scroll up and click the Get Form button.

- Follow the green pointer and start filling out all the required fields.

- To complete the document, use the various annotation and editing tools, such as checkmarks, circles, and crosses.

- Review the document and check for errors and typos.

- Click Done to finalize the process and download the form.

- Select the option to send the form via USPS in your Dashboard if you prefer to send it via mail.

Is 8938 Form accompanied by other forms?

Initially, Form 8938 was part of FATCA (Foreign Account Tax Compliance Act). According to the regulations, an individual fills out Form 8938 and attaches it to their annual return, which may be one of the following: Form 1040, Form 1040NR, Form 1041, etc.

When is IRS Form 8938 due?

The form should be sent to the IRS only when attached to the annual return or amended return by April 18th, 2025.

Where do I send 8938 Form?

Send the form and the annual income return to the IRS.