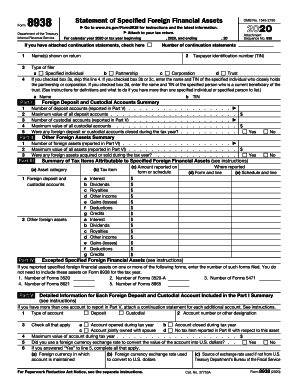

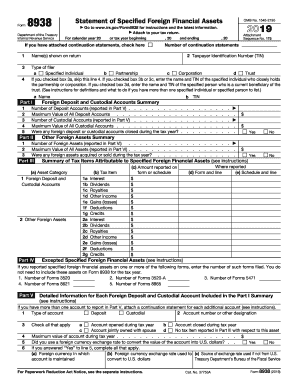

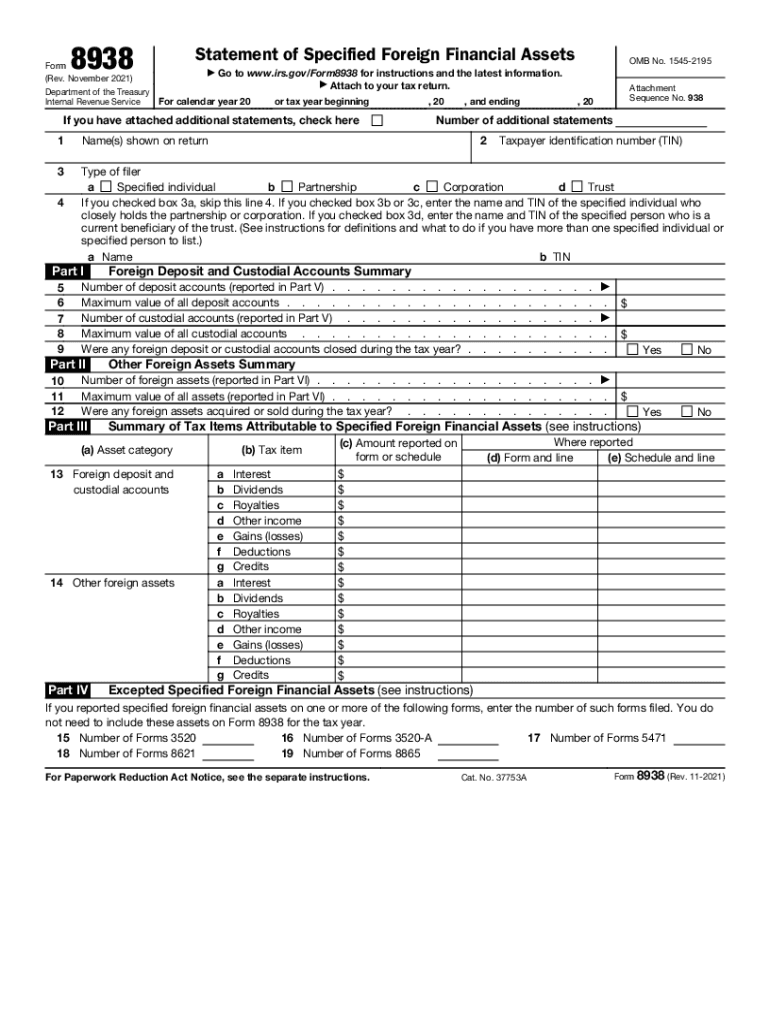

IRS 8938 2021-2026 free printable template

Instructions and Help about IRS 8938

How to edit IRS 8938

How to fill out IRS 8938

Latest updates to IRS 8938

All You Need to Know About IRS 8938

What is IRS 8938?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8938

How can I correct mistakes after filing IRS 8938?

If you realize there are mistakes on your submitted IRS 8938, you can submit an amended form. It's crucial to clearly indicate that it's an amendment and explain the reasons for the changes. This ensures the IRS processes your corrected filing properly.

What should I do if I receive an IRS notice after filing?

Upon receiving an IRS notice related to your IRS 8938, carefully read the document to understand the issue. Prepare any necessary documentation and respond within the specified timeframe to resolve the matter satisfactorily.

How can I verify the IRS received my IRS 8938 filing?

To verify receipt of your IRS 8938, you can check your submission status through the IRS e-File system if you filed electronically. Alternatively, contacting the IRS directly can provide confirmation for any paper submissions.

What e-file rejection codes might I encounter with IRS 8938?

Common e-file rejection codes for IRS 8938 may include issues like missing taxpayer information or discrepancies in reported income. Reviewing the specific rejection code can help you correct the filing and resubmit successfully.

Is e-signature acceptable for filing IRS 8938?

Yes, the IRS accepts e-signatures for filing Form 8938. Ensure that your e-signature complies with IRS guidelines, as this enhances the efficiency and security of your submission.

See what our users say